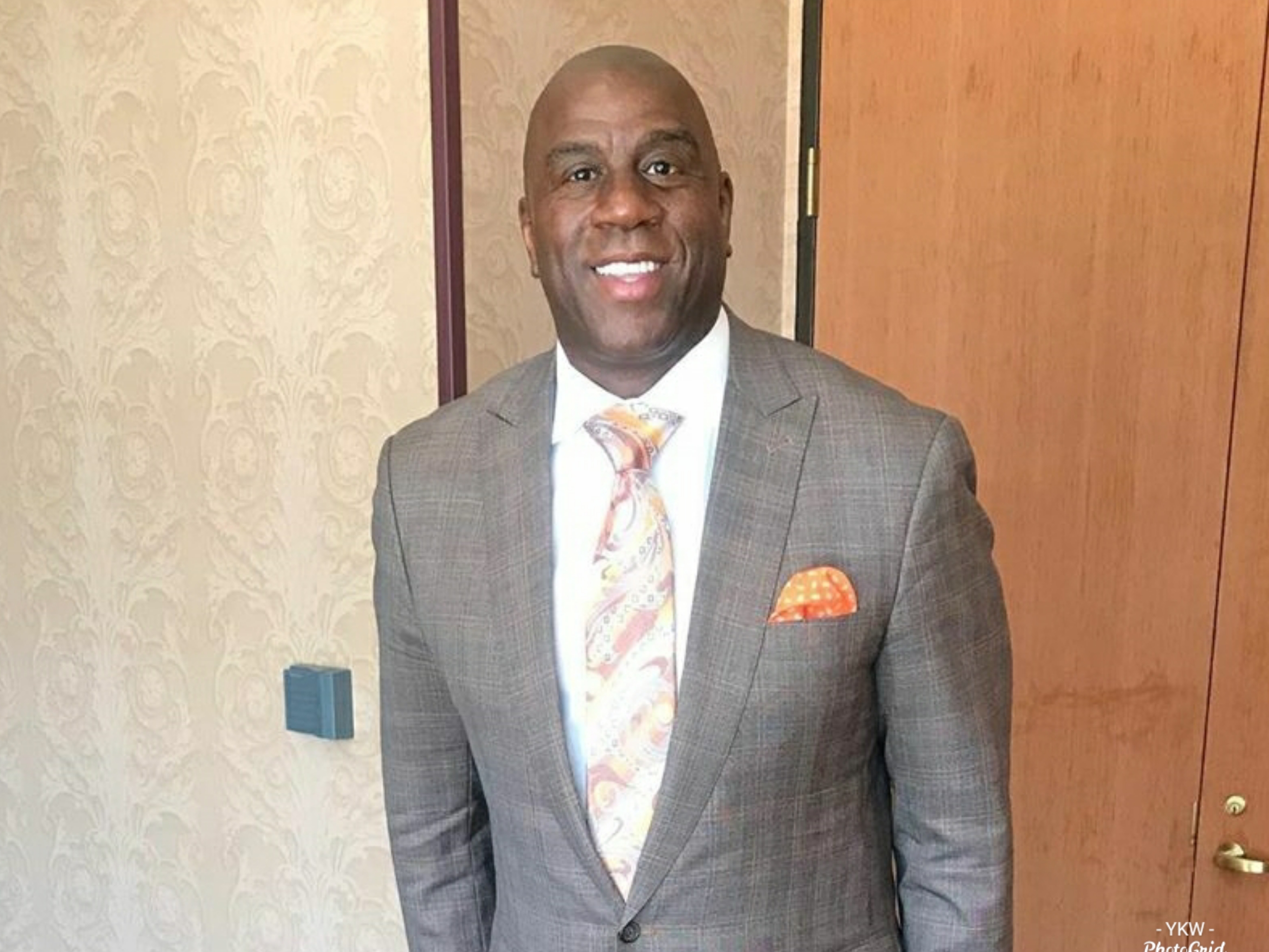

Former NBA player, Magic Johnson, plans to help small minority businesses struggling to get Paycheck Protection Program loans. Johnson shared the news on Instagram.

Johnson’s life Insurance company, Johnson’s EquiTrust Life Insurance Co., is partnering with MBE Capital Partners, a New Jersey-based non bank lender, to fund $100 Million in small business loans. Johnson and Martinez met through Rev. Al Sharpton, the Wall Street Journal reported.

The PPP loans were designed to help small businesses struggle during the shutdown of non-essential businesses, yet small businesses are unable to obtain funds.

MBE’s chief executive, Rafael Martinez, received complaints from clients who couldn’t get PPP’s first round of funding. Larger businesses like Shake Shake, Ruth’s Chris Steak House and the Lakers were able to obtain tens of millions in PPP loans — however they received so much backlash they had to return the funds.

“We knew why the money was gone and couldn’t trickle down to small businesses, especially small minority businesses, because they didn’t have those great relationships with the banks, Johnson told the WSJ. “So this was easy for us to understand.” Indeed, reports reveal that lenders prioritized businesses whom they had existing relationships with.

“This is, when you think about it, life and death for so many business owners. They have nowhere else to turn,” Johnson told the WSJ.

In late April, a new round of funding, worth $310 billion, was approved, Fortune reported. The first disbursement was chaotic, dried up quickly, and excluded small business. No one knows how this disbursement will be different. Martinez and Johnson are not waiting to find out. Martinez told the WSJ that Johnson’s $100 million commitment will first be used for the 5,000 PPP loans his company has approved.

Their effort will be made through the Small Business Administration PPP program, and is part of a partnership with MBE Capital Partners (a New Jersey-based firm that specializes in loans to businesses owned by women and minorities), according to Forbes.